40 valuing zero coupon bonds

Zero Coupon Bond: Definition, Formula & Example - Video ... The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 + i )^ n where: M = maturity value or face value. i ... What Is a Zero-Coupon Bond? | The Motley Fool Zero-coupon bonds compensate for not paying any interest over the life of the bond by being available for far less than face value. Put another way, without a deep discount, zero-coupon bonds ...

Zero Coupon Bond Value Calculator: Calculate Price, Yield ... Since zero coupon bonds do not pay a coupon, any capital appreciation remains in the bond. Since they sell at a discount to their stated maturation value they are known as discount bonds. In a falling rate envirnoment zero-coupon bonds appreciate much faster than other bonds which have periodic coupon payments.

Valuing zero coupon bonds

Zero Coupon Bond - WallStreetMojo Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest. Compound Interest Compound interest is ... What does it mean if a bond has a zero coupon rate? A bond's coupon rate is the percentage of its face value payable as interest each year. A bond with a coupon rate of zero, therefore, is one that pays no interest. However, this does not mean the ... Zero Coupon Bond Calculator - What is the Market Value? Zero Coupon Bond Calculator Inputs. Bond Face Value/Par Value ($) - The face or par value of the bond - essentially, the value of the bond on its maturity date. Annual Interest Rate (%) - The interest rate paid on the zero coupon bond. Years to Maturity - The numbers of years until the zero coupon bond's maturity date.; Months to Maturity - The numbers of months until bond maturity (not this ...

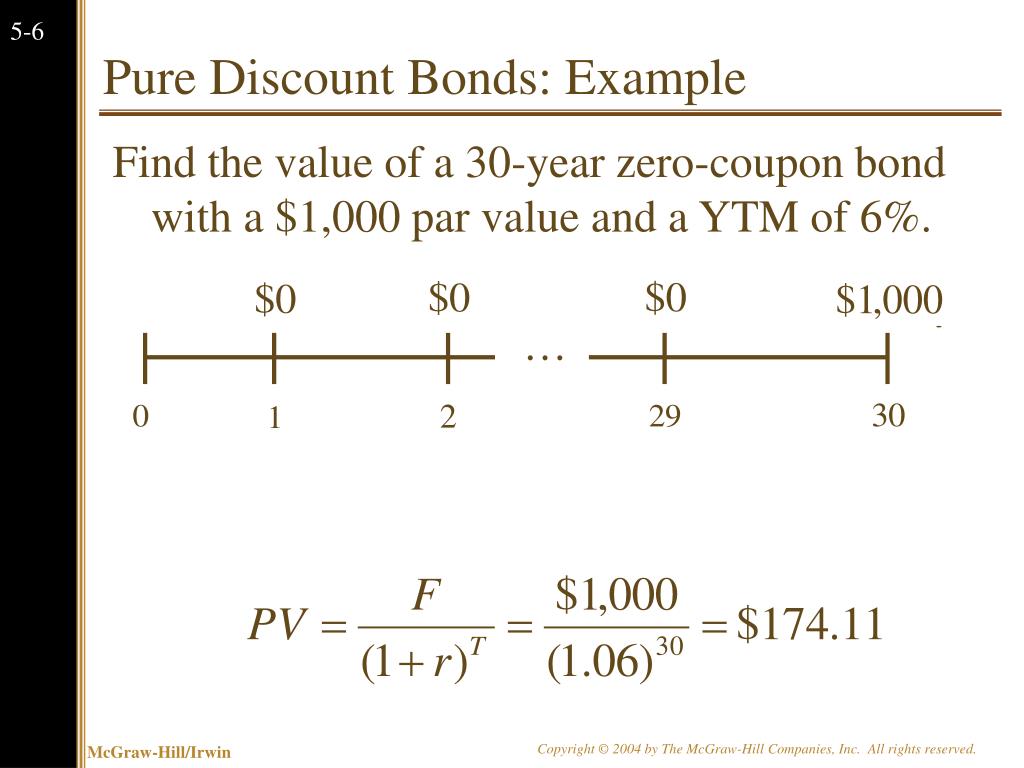

Valuing zero coupon bonds. How to Calculate a Zero Coupon Bond Price | Double Entry ... The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) The present value of the cash flow from the bond is 816, this is what the investor should be prepared to pay ... Pricing using the Zero-Coupon Yield Curve and an Arbitrage ... Valuing a fixed-rate coupon bond with no embedded options using the arbitrage-free lattice and the spot curve leads to the same bond value. This holds because the binomial interest rate tree is arbitrage-free. However, the spot curve will not work for bonds with embedded options. Example: Zero-Coupon Yield Curve 11 Valuing a Zero Coupon Bond a A zero coupon bond with a ... See Page 1. 11. Valuing a Zero-Coupon Bond. a. A zero-coupon bond with a par value of $1,000 matures in 10 years. At what price wouldthis bond provide a yield to maturity that matches the current market rate of 8 percent? ANSWER: ANSWER : PV 11)k( C += PV 100801 0001).(, += PV= $463.19 b. Zero Coupon Bond - Meaning A Zero Coupon Bond is a special type of bond which pays the face value at maturity and does not pay any interest during the life of the bond. So, there is no concept of coupon payments for these bonds. These are also known as Discount Bonds or Accrual Bonds. In the case of normal bonds, the coupon rate is a very important parameter to calculate ...

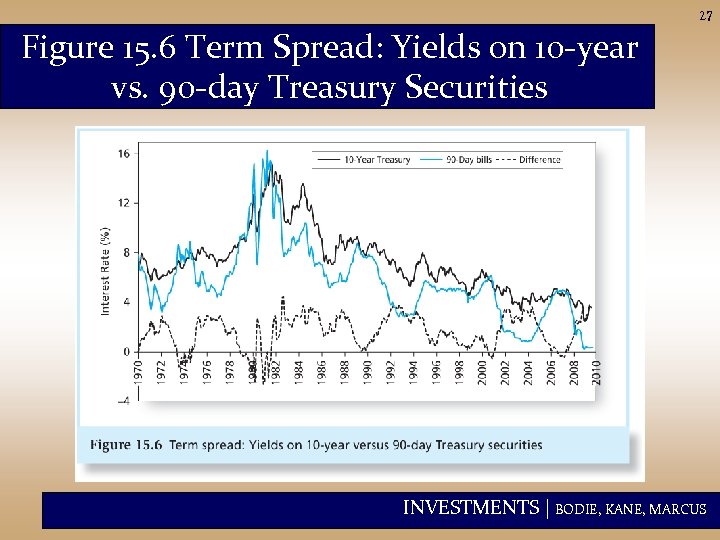

Tutorial 4 Answers - Chapter 6 Valuing Bonds - Warning ... Valuing Bonds. 6- 3. The following table summarizes prices of various default-free, zero-coupon bonds (expressed as a. percentage of face value): a. Compute the yield to maturity for each bond. b. Plot the zero-coupon yield curve (for the first five years). c. Is the yield curve upward sloping, downward sloping, or flat? a. Solved 1. Valuing a Zero-Coupon Bond Assume the | Chegg.com Valuing a Zero-Coupon Bond Assume that you require a 14 percent return on a zero-coupon bond with a par value of $1,000; Question: 1. Valuing a Zero-Coupon Bond Assume the following information for existing zero-coupon bonds: Par value = $100,000 Maturity =3 years Required rate of return by investors = 12% How much should investors be willing ... PDF Numerical Example in Valuing Zero coupon Bonds Numerical Example in Valuing Zero Coupon Bonds William L. Silber Year 0 1 3 5 10 Interest Rate a) 10% 1000.00 909.09 751.31 620.92 385.54 b) 7% 1000.00 934.58 816.30 712.99 508.35 NOTES: 1) Each entry in the table represents the value of a zero coupon bond with a face value of $1000. Zero-Coupon Bond Definition - Investopedia Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Zero Coupon Bonds Explained (With Examples) - Fervent ... The value of a zero coupon bond is nothing but the Present Value of its Par Value. Zero Coupon Bond Example Valuation (Swindon Plc) Consider an example of Swindon PLC, which is issuing a zero coupon bond with a par value of £100 to be paid in one year's time. Solved 2. Valuing a Zero-Coupon Bond. Assume the following ... Answer to Solved 2. Valuing a Zero-Coupon Bond. Assume the following Zero-Coupon Bond Value | Formula, Example, Analysis ... The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is: Price = M / (1+r)n. where: M = maturity value or face value of the bond. r = rate of interest required. n = number of years to maturity. Zero Coupon Bond Value - Formula (with Calculator) Example of Zero Coupon Bond Formula. A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Zero-Coupon Bond: Formula and Excel Calculator In contrast, for zero-coupon bonds, the difference between the face value and the bond's purchase price represents the bondholder's return. Due to the absence of coupon payments, zero-coupon bonds are purchased at steep discounts from their face value, as the next section will explain more in-depth.

Zero Coupon Bond Value Formula: How to Calculate Value of ... A zero-coupon bond is a type of bond that doesn't make coupon payments. This type of bond is issued with a big discount to its face value. At the time of maturity, the bondholder receives the face value of the bond, which means that the current price has to be lower than the face price. The investor's earnings come entirely from the gain on redemption because there are no coupon payments.

![[最も人気のある!] yield to maturity formula zero coupon bond 161022-Yield to maturity formula zero ...](https://img.yumpu.com/56848958/1/500x640/explain-conceptually-how-bonds-are-priced-moreover-define-yield-to-maturity-q2-diane-is-interested-in-buying-a-five-year-zero-coupon-bond-with-a-face-value-is-1000.jpg)

[最も人気のある!] yield to maturity formula zero coupon bond 161022-Yield to maturity formula zero ...

Valuation of Zero-Coupon Bonds - YouTube This video provides an explanation of a zero-coupon bond and proceeds to show how the value and yield are calculated using manual computations as well as wit...

Zero Coupon Bond - Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't ...

Valuing Bonds | Boundless Accounting zero-coupon bond: A zero-coupon bond (also called a discount bond or deep discount bond) is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. "Beat Back the Hun with Liberty Bonds" : After war was declared, the moral imperative of liberty and the Allied cause was touted in official ...

PDF CHAPTER 33 VALUING BONDS - New York University At the extreme, if the bond is a 'zero-coupon' bond, the only cash flow is the face value at maturity, and the present value is likely to vary much more as a function of interest rates. Figure 33.2 illustrates the percentage changes in bond prices for six thirty-year bonds with coupon rates ranging from 0% to 10% for a range of interest rates.

Coupon Bond - Guide, Examples, How Coupon Bonds Work The issuer of the bond agrees to make annual or semi-annual interest payments. equal to the coupon rate to investors. These payments are made until the bond's maturity. Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value.

Valuing a zero-coupon bond | Mastering Python for Finance ... Valuing a zero-coupon bond. A zero-coupon bond is a bond that does not pay any periodic interest except on maturity, where the principal or face value is repaid. Zero-coupon bonds are also called pure discount bonds.. A zero-coupon bond can be valued as follows:

Post a Comment for "40 valuing zero coupon bonds"